Develop Your Own Insights

Businesses can choose from over 100 data points on our platform. A business can gain custom insights tailored to their specific needs by leveraging this extensive dataset.

Loading

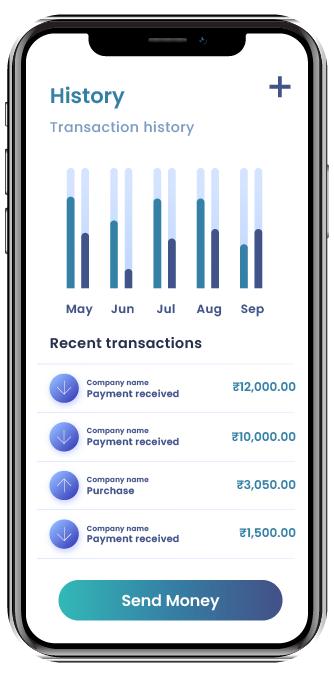

Where precision meets personalization in finance

Businesses can choose from over 100 data points on our platform. A business can gain custom insights tailored to their specific needs by leveraging this extensive dataset.

Analyze the ability of New-to-Credit customers to repay their EMIs. Analyze advanced data to determine the creditworthiness of customers without traditional credit histories.

We provide businesses with over 20+ fraud indicators through our platform. Businesses can identify and mitigate fraudulent activities by leveraging these indicators.

Know what your customers earn, where they spend, and what they invest. Identify their sources of income, expenditure categories, and investment preferences.

Wealth management expertise tailored for you.

Analyze your users' data to get the insights you want.

Streamline your financial data into our insights APIs.

Consumer insights are available in your chosen format.